Employee theft costs employers up to $50 billion annually and negatively affects about 95% of businesses, 75% of employees admit to stealing from their employer at least once, and 60% of employees would steal if they knew they wouldn’t get caught. Clearly the need for National Honesty Day on April 30th has never been greater.

My husband Robert is one of the 22% of small business owners to experience employee theft. The trust and responsibility held by employees in a small business put him at greater risk of being robbed.

Want to subscribe to receive blog updates sign up today!

Robert was confident when he hired another little person we had known since she was a teenager as Secretary #7 in his rehabilitation engineering practice serving people with disabilities. He saw no reason to run a background check. Not that it would have exposed a problem; she like 96% of employee thieves had no prior fraud convictions. Robert expected her to do well with her bright personality, four-year degree, personal knowledge of disability issues, and work experience. She was in her 20s and nowhere near 49, an embezzler’s median age.

One of #7’s duties was to prepare checks for Robert’s signature. Her degree made learning the accounting program easy, but did not insulate Robert from becoming a fraud victim; 49% of employee theft is performed by those with a university degree.

After only six weeks of employment, #7 embezzled the first of 21 checks. She took advantage of being in a smaller organization where check and payment tampering is four times more likely. After seven months, #7 was fired for poor performance, unpredictable behavior, and lying. We didn’t know if she was living beyond her means or having financial difficulties, but it was evident that she coveted my new car. In hindsight, we know these were embezzlement red flags.

After #7’s termination, Robert noticed bookkeeping anomalies and requested copies of canceled checks from the bank. We were stunned to see his forged signature on checks totaling $9,164.68. She even forged a check to pay her taxes. And the reason #7 gave for stealing? She needed the money.

Only 16% of companies call the police to launch an employee theft investigation. But Robert agreed to be a support witness in the banks criminal prosecution of #7. She was arrested, charged with 21 felony counts of forgery and altering business records. Although she could have served prison time, a plea bargain led to three years’ probation, counseling, and restitution. Her father was a big part of this generous deal because his restitution payment of $4,000 persuaded the district attorney to plead the charges down to misdemeanors.

We didn’t want #7 to go to prison, but in his victim statement to the judge, Robert recommended community service hoping it would give her an appreciation of those truly in need. We were amazed when she did pay all the court-ordered restitution. The bank manager told us that this almost never happens. According to employee theft statistics, businesses typically get back less than half of their stolen money.

If you’re a victim, get help during National Crime Victims’ Rights Week, April 24-28, 2023. Contact Carla at CILO at 561-966-4288 ext. 125 or email cpazmino@cilo.org.

Image credit: Tumisu from Pixabay. https://pixabay.com/photos/stealing-money-cash-dollar-case-3937735/

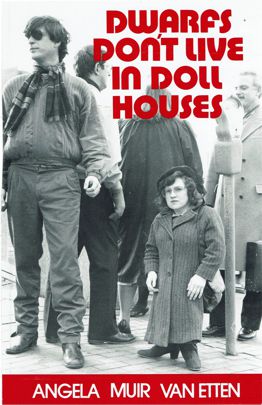

This post is based on an excerpt from the second book in my dwarfism trilogy, “Pass Me Your Shoes: A Couple with Dwarfism Navigates Life’s Detours with Love and Faith.” For more information and memoir buy links, go to https://angelamuirvanetten.com where you can also subscribe to my weekly blog.